Tax Rates

Tax Rates are where you setup the actual tax rate, and what country, state/province, Product Tax Class and Customer Tax Class that it applies to.

You would use Tax Rates to setup sales tax or VAT.

You can setup as many taxe rates that you need and configure how they are calculated.

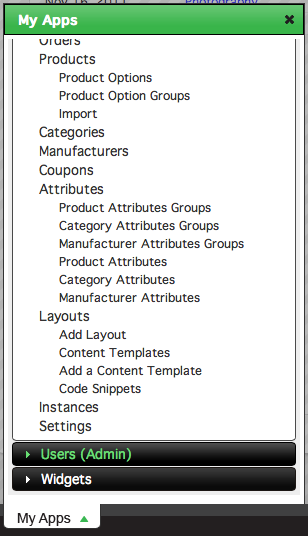

To access the tax rates for your store, click on Settings under Store in the My Apps menu.

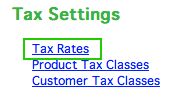

Click on Tax Rates under Tax Settings.

The Tax Rates screen lists all tax rates for your store. To add a new tax rate, click Add a New Tax Rate in the top right of the screen.

![]()

If you are changing an existing tax rate, click edit to the left of the rate you want to edit.

The process for adding and editing tax rates is the same.

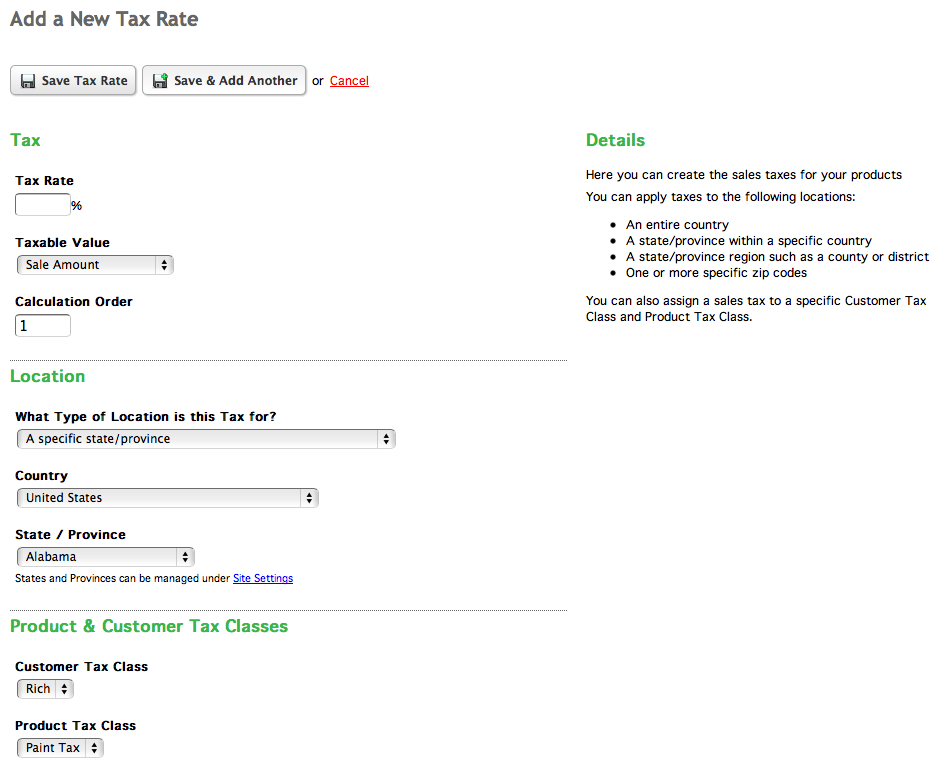

The Add/Edit Tax Rate window allows you control what percentage is added to a sale as tax as well as which products to apply it to and what types of customers to apply it to.

Tax

Set a tax rate at the top of the window in the Tax Rate field.

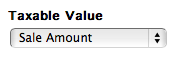

You can set what prices to apply the tax rates to by choosing an option from the Taxable Value menu.

Options include:

- Sale Amount: the total sale amount of the order before taxes and shipping

- Sale Amount + taxes: the total sale amount before shipping plus any taxes that have already been calculated

- Shipping: just the shipping cost for the order

The Calculation Order is used if there are multiple tax rates that are going to affect an order. If you need one specific tax rate to be applied before others during the checkout process, you would set the order using this field.

Location

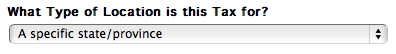

The Location section allows you to set the tax rate to apply to only certain orders that occur in the the place you specify.

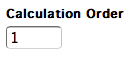

Set what type of location the tax is for by choosing an option from the What Type of Location is this Tax for? menu.

Options include:

- An entire country

- A specific state/province

All orders shipped to that state/province will have this tax applied - A specific state/province region such as a county or district

This is useful if sales tax is calculated based on county or region. Some states in the US (like New York) operate this way. - One or more specific zip/postal codes

Choosing An entire country will allow you to specify which country you want the tax rate to apply to from the Country menu.

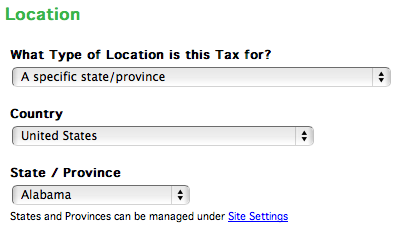

Choosing a specific state/province will show the State/Province menu under the Country menu. States and provinces can be configured in the site settings. Select a state or province from the State/Province menu.

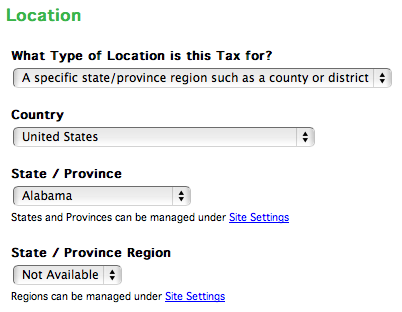

Choosing a specific state/province region such as a county or district allows you to choose a region from the state or province that you chose from the State/Province menu. You can set up these regions in the site settings.

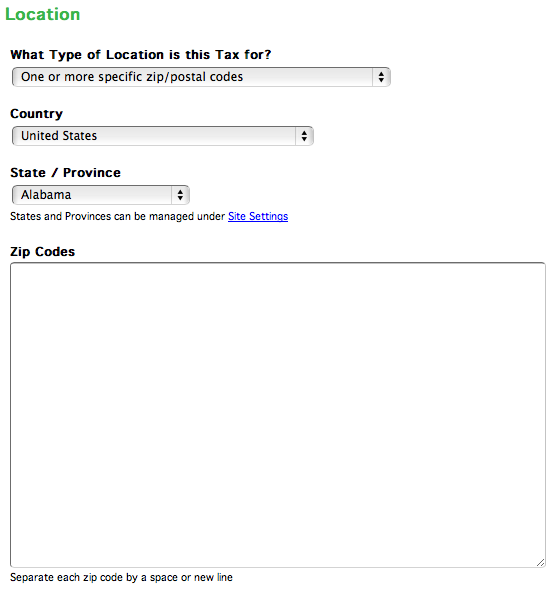

Lastly, if you choose One or more specific zip/postal codes, you can type out a list of zip or postal codes in the Zip Codes field to apply your tax rate to. These Zip and Postal codes should be separated by a space or placed on new lines.

Product & Customer Tax Classes

To apply your tax rate to a customer tax class, pick an option from the Customer Tax Class menu.

![]()

To apply your tax rate to a product tax class, pick an option from the Product Tax Class menu.

Save the tax rate after you are finished configuring it.